I'd rather not further cement tips as a fundamental part of our economic system. It's gotten so stupid to the point where you get asked for a tip before any service has even occurred and then the "service" is often just counter service which used to not be tipped. By not taxing this income, you're encouraging more income to be paid through tips to avoid taxes. When you're making all these little exemptions and special cases, maybe it's time to rethink the fundamental system so that it works better as a base case rather than having all these poorly-applied bandaids.

politics

Welcome to the discussion of US Politics!

Rules:

- Post only links to articles, Title must fairly describe link contents. If your title differs from the site’s, it should only be to add context or be more descriptive. Do not post entire articles in the body or in the comments.

Links must be to the original source, not an aggregator like Google Amp, MSN, or Yahoo.

Example:

- Articles must be relevant to politics. Links must be to quality and original content. Articles should be worth reading. Clickbait, stub articles, and rehosted or stolen content are not allowed. Check your source for Reliability and Bias here.

- Be civil, No violations of TOS. It’s OK to say the subject of an article is behaving like a (pejorative, pejorative). It’s NOT OK to say another USER is (pejorative). Strong language is fine, just not directed at other members. Engage in good-faith and with respect! This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban.

- No memes, trolling, or low-effort comments. Reposts, misinformation, off-topic, trolling, or offensive. Similarly, if you see posts along these lines, do not engage. Report them, block them, and live a happier life than they do. We see too many slapfights that boil down to "Mom! He's bugging me!" and "I'm not touching you!" Going forward, slapfights will result in removed comments and temp bans to cool off.

- Vote based on comment quality, not agreement. This community aims to foster discussion; please reward people for putting effort into articulating their viewpoint, even if you disagree with it.

- No hate speech, slurs, celebrating death, advocating violence, or abusive language. This will result in a ban. Usernames containing racist, or inappropriate slurs will be banned without warning

We ask that the users report any comment or post that violate the rules, to use critical thinking when reading, posting or commenting. Users that post off-topic spam, advocate violence, have multiple comments or posts removed, weaponize reports or violate the code of conduct will be banned.

All posts and comments will be reviewed on a case-by-case basis. This means that some content that violates the rules may be allowed, while other content that does not violate the rules may be removed. The moderators retain the right to remove any content and ban users.

That's all the rules!

Civic Links

• Congressional Awards Program

• Library of Congress Legislative Resources

• U.S. House of Representatives

Partnered Communities:

• News

Looks like many haven't read the article before commenting. While both candidates have a proposal about the same topic, the methodology of implementing this seems to differ greatly.

The reaction in the comments appears to reflect more of the potential outcome of the Trump plan, though the Trump plan seems to mainly be some cobbled together bits of some other Republican proposals.

From the article, the Harris plan goes along with a minimum wage increase and an income cap so higher wage workers can't collect tax free "tips" in lieu of taxable income.

I also looked up some implications of elimination of taxed tips and found this article that goes into some numbers and shows how raising the standard deduction to make more workers, not just tipped workers, exempt from income tax and benefit many more people. I thought that was interesting and provided more seemingly useful info than either candidates' campaign promises.

Why don't they just fix the minimum wage problems and stop allowing tipped jobs to have a lower minimum wage. Also stop letting million plus "charity" organizations employ disabled workers at $0.25. ( Goodwill is a scam)

Big difference is she is likely serious. Im not sure how I feel. These are not the highest paid things but I hate encouraging tips over regular reliable pay.

"She stole my idea!"

"Even a broken clock is right twice a day, we're still waiting for your second time..."

Twitter and reddit are on fire with indignation that Harris DARE consider even one of their high priest's ideas viable.

This is utter nonsense. Outlaw tips and make them subject to normal minimum wage.

" . . . echoing trump vow"

FY AP.

Wait... Why wouldn't tipped employees pay taxes on that part of their income? Or am I not understanding what they mean?

I worked for tip for over a decade and to me it's perfectly normal that I would pay taxes on my earnings, especially when I had colleagues that didn't work for tip with about the same total income and taxes would be taken from their paycheque automatically, why would I not pay taxes on half my income if they had to?

Until Reagan there wasn't any tax on tips because it was considered gifts, not income. The word 'gratuity' still reflects that.

The increase of the minimum wage seems more interesting.

This is dumb but politically necessary. Big issue in Nevada, good signifier of who is "on the side of the working person."

But specifically making tips non-taxable encourages more employment to be tip-based.

Makes more sense to cut taxes for these same people by expanding the tax bracket that goes untaxed (currently first $11k).

I think we might start to see CEOs working for tips.

A CEOs income really isn't what they're avoiding paying taxes on.

They would totally do that. It's not far from the $1 salary with millions in stock incentive scam.

Typically they do, just they call it a "performance bonus" and it's baked into their contract

Tips are bullshit and workers should be required to paid a living wage.

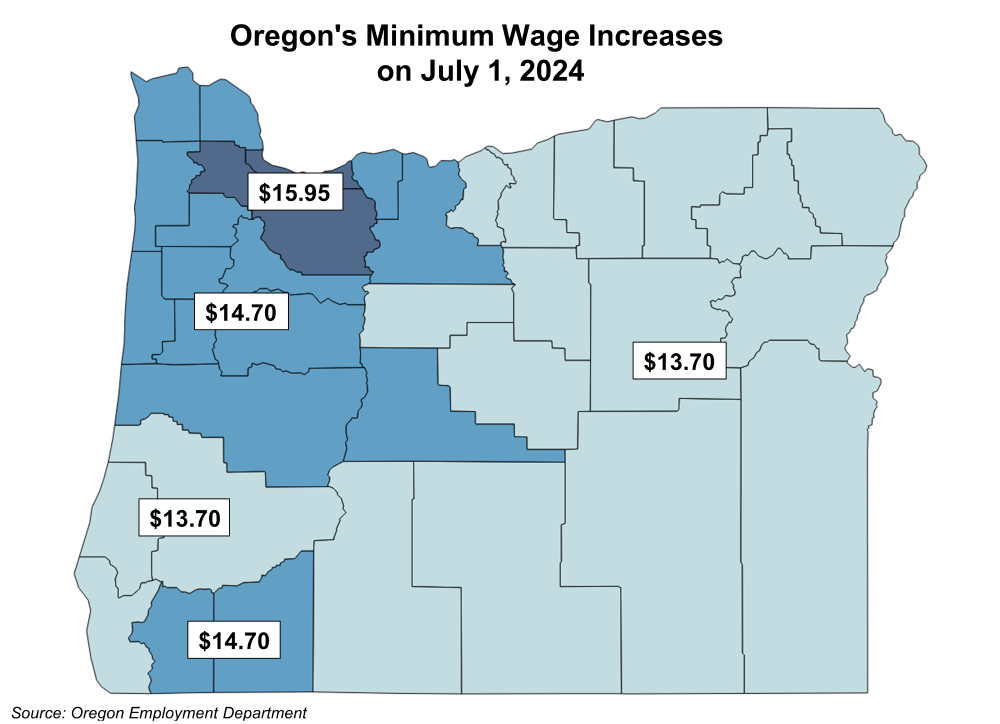

In Oregon, even tipped workers make the state minimum wage, but what that wage is varies depending on location.

Portland metro has the highest, it just went up on 7/1 to $15.95.

Other population centers like Salem, Eugene, Roseburg, Bend, Medford, and tourist spots on the coast have a lower rate of $14.70.

The rural areas where there are more meth labs and cows than people are at $13.70.

Map:

Good for Oregon. Until a living wage is implemented nationwide it is a problem that needs to be addressed.

and now the employee's are going to be asking for more tips instead of wage, so they pay less tax.

You think everyone one asking for a tip at the cashier is bad now?

Wait till they put this in.

You think everyone one asking for a tip at the cashier is bad now?

Yeah, this will just make it even more prevalent for sure.

I think the proliferation of tips at almost every register instead of being limited to full service has been bad since the trend started.

In my state restaurants pay the federal tipped minimum of just over 2 dollars an hour. Their entire income is based on tips, and until they are required to be paid a living wage, tips are a necessary evil. I tip them well because I know they are getting screwed on their paychecks more than any other job.

Keep in mind that cash tips tend to not be taxed, which means less going into social security, medicare/medicaid, and other government services. It is still income! But when it was mostly cash it was effectively tax free.

Now that cards are prevalent it is getting taxed, and this 'no tax on tips' bullshit instead of requiring a living wage just benefits business. It is a counterproductive 'fix' and fuck tipping culture altogether.

You know what the worst outcome of non-taxed tips will be? The fucking wealthy tipping each other tax free to move money around. That is what it will end up being in a couple decades because that is consistent with every other similar 'fix' that just avoids requiring a living wage.

Where I'm at it's automatics, for restaurant jobs 10% of the bill is calculated as additional income for the employee who's got their name on the receipt, if they want to add more to their taxes it's up to them but otherwise income is income is income and people need to pay taxes on theirs.

Good. Taxing tips is bullshit. Even 45 can be accidentally right once in a while. Do Tax on Wall Street Speculation instead.

Why is it bullshit? Just because your income comes from clients instead of your boss doesn't mean it's not income.

Hell, the US became the US because of the "no taxation without representation" thing, should people who work for tip not be eligible to vote?

Because employers use tips as a reason to pay workers less, even less than minimum wage. It's a tax on the lower working class. Meanwhile executives like Bezos pay almost zero taxes.

So why choose the wrong solution then? Tax billionaires fairly. Don't arbitrarily make the waiter not pay taxes but the cook in the back has to? That's not equal, that's not fair.

I think tips in general are bullshit and the real answer is to raise minimum wage much higher, so it keeps up with worker productivity. I would prefer that, and to do away with tipping culture entirely. However, passing a tax relief thing is always much easier goal in the US than raising minimum wage, so I'm not letting an ideal internet reply guy solution get in the way of something that actually helps workers. As for it not being fair to the cooks in the back, different jobs pay differently. And believe it or not, some wait staff do share tips with the cooks.

I would be thrilled if Harris announced taxes on Wall Street shenanigans.

But I highly doubt it

Maybe we should talk about the history behind taxing tips...and Social Security checks. Hint: it was Ronald Reagan and he raised them to pay for cutting taxes for the wealthy and corporations

Why shouldn’t people pay taxes on tips, though? I pay taxes on 100% of my income…

My answer would be that there shouldn't be tips. Everyone should be receiving a living wage and tips should be relegated to the vulgar past.

So much that is wrong with our country now was put into motion by that shitstain and his cadre.

Thank you! I did not know that.

It always comes back to Reagan. This is what happens when you elect an actor celebrity with fucking active dementia to office. He becomes a useful tool to enact policy that the general public does not benefit from because he can remember the lines and deliver it in a package that they are willing to swallow.

Let's not do it again.

Associated Press - News Source Context (Click to view Full Report)

Information for Associated Press:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this source

Search topics on Ground.News

https://apnews.com/article/harris-walz-nevada-trump-las-vegas-ac21118dbb24290e46d32ad9669507d4