Most of Europe rents, even people who make 6 figures and live in big cities…there’s absolutely no stigma attached to renting, in contrary people who decided to get a 35 year mortgage for an overpriced house (which often isn’t even a single house but a semi or a house with 3 ft of land around it) to live on the outskirts among conservative simpletons are thought of as suckers… It helps though that in the EU renters have rights and landlords are extremely limited in terms of raises or contract changes.

Canada

What's going on Canada?

Communities

🍁 Meta

🗺️ Provinces / Territories

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

- Yukon

🏙️ Cities / Local Communities

- Calgary (AB)

- Edmonton (AB)

- Greater Sudbury (ON)

- Halifax (NS)

- Hamilton (ON)

- Kootenays (BC)

- London (ON)

- Mississauga (ON)

- Montreal (QC)

- Nanaimo (BC)

- Oceanside (BC)

- Ottawa (ON)

- Port Alberni (BC)

- Regina (SK)

- Saskatoon (SK)

- Thunder Bay (ON)

- Toronto (ON)

- Vancouver (BC)

- Vancouver Island (BC)

- Victoria (BC)

- Waterloo (ON)

- Winnipeg (MB)

🏒 Sports

Hockey

- List of All Teams: Post on /c/hockey

- General Community: /c/Hockey

- Calgary Flames

- Edmonton Oilers

- Montréal Canadiens

- Ottawa Senators

- Toronto Maple Leafs

- Vancouver Canucks

- Winnipeg Jets

Football (NFL)

- List of All Teams:

unknown

Football (CFL)

- List of All Teams:

unknown

Baseball

- List of All Teams:

unknown - Toronto Blue Jays

Basketball

- List of All Teams:

unknown - Toronto Raptors

Soccer

- List of All Teams:

unknown - General Community: /c/CanadaSoccer

- Toronto FC

💻 Universities

💵 Finance / Shopping

- Personal Finance Canada

- BAPCSalesCanada

- Canadian Investor

- Buy Canadian

- Quebec Finance

- Churning Canada

🗣️ Politics

- Canada Politics

- General:

- By Province:

🍁 Social and Culture

Rules

Reminder that the rules for lemmy.ca also apply here. See the sidebar on the homepage:

As a young person, I love living astronomically.

Nice job with the headline quote, BNN Bloomberg writer.

Is anyone else annoyed by the advice that young people should give up hope of paying their own mortgage for their own home in favor of paying their landlord's mortgage via rent? "People need to shift the idea that to be successful you have to own a home. It’s just not going to be in the cards for some people, and they’re in a worse position for trying to own a house,” she said."

I say that instead of telling young people to give up on goals we should, as a nation, protect owning a home as if it was a basic necessity and do something about large %'s of homes/condos being owned by investors. It was possible to buy a home on a single income just a few generations ago. I'm sure it can be again if we make housing security a priority.

I don't think that's the advice. Rather that renting can be significantly cheaper and less risky to your savings in the current market. Here's an anecdote from where I live. If you were to buy the unit I live in today, you'd have to pay $3700/mo in mortgage, $1000 in maintenance, and $250 in taxes. That's $4950/mo to "own" this place. Instead you could rent it for $3200. That's $1750 difference. That's a lot more than what's going to be going towards your principal, your equity in the purchase case. Out of the $4950/mo, only $860/mo would be going towards equity. Everything else goes in someone else's pocket. The renter would be able to stash more money than you till your 13th year in the mortgage. If this is the reality you're looking at renting is significantly cheaper. I think that's what the advice is about.

You're ignoring the fact that the house is appreciating in price more than $1750x12 per year. In fact, my house has appreciated around $500,000 in the 3.5 years since I bought it, which is about $12,000 per month. Plus I get the principal amount I've paid in back on top of that.

So while it's cheaper every month to rent and they do have more cash in their pocket today, it's FAR better financially to own. I will be able to retire easily with a paid off mortgage and very low living expenses, a renter may never have enough cash saved to be able to retire at market rental rates even if they put every single dollar they save each month away.

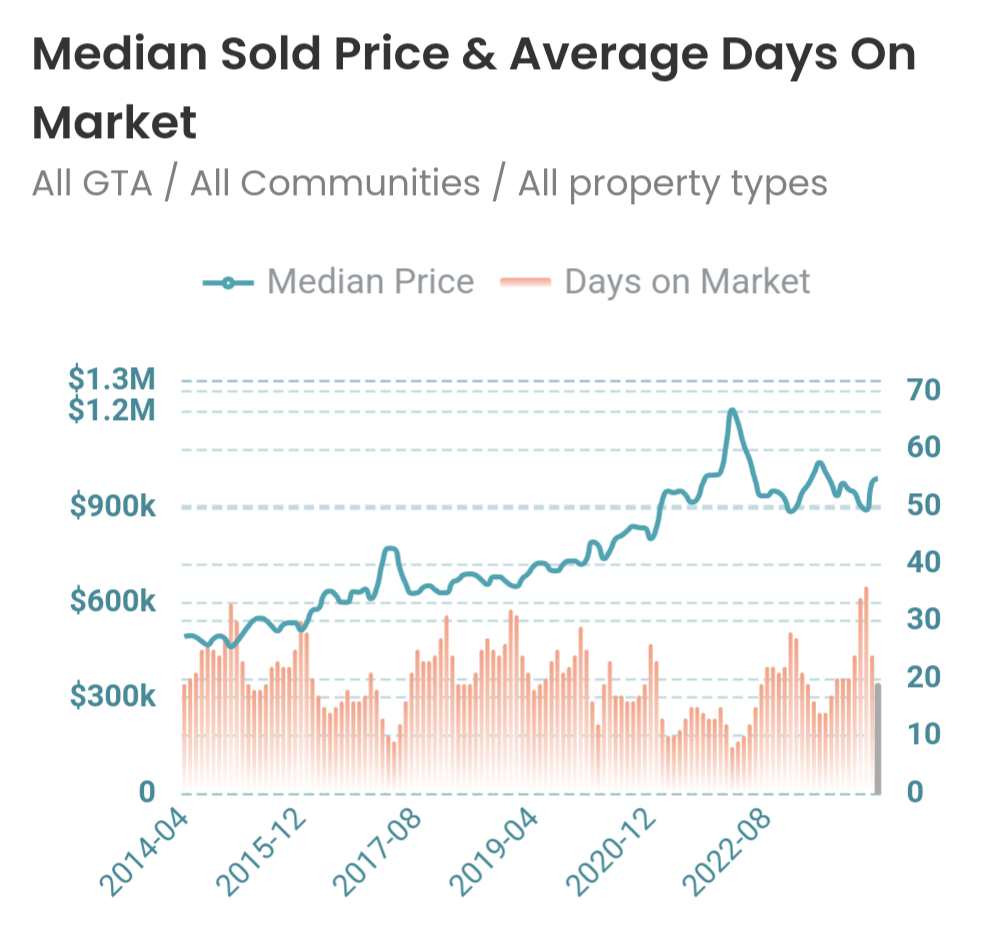

This is true if it-only-goes-up. Prices in the GTA for example have been flat since they came down from the peak in 2022:

So I'm only ignoring price appreciation because not all markets in Canada are upwards moving and I'm not betting it's gonna go up or down.

If you bought at the peak then lost your job and had to sell you'd have lost your down payment. The 5x leverage works both ways. Such people weren't as lucky as you and they do exist.

If prices stagnate and a renter saves more on housing than you pay in equity, at the end of your mortgage, they'd be able to buy your house with their savings and live just as comfortably without paying rental market prices.

So yeah, buying is a far better investment today, only if you bet it's going to go up. And only if you make enough money (200K to comfortably support the below-median 740K scenario above) so that you're able to absorb shocks without being forced to sell at an unfavorable time/price. It has been true for a while and if (when) interest rates fall, prices are likely to go up, but that would only happen because it would become cheaper to carry the higher mortgages required to inflate the prices further, because incomes are not rising nearly as fast.

In my opinion (and I think the article's) buying today with lower income where you have little buffer left after paying those 5K is a recipe for disaster. I would rent when significantly cheaper than buying, buy when similar or cheaper than renting.

Then they go on to say that home ownership is one of the primary forms of wealth accumulation in Canada like two sentences later. If you read between the lines a bit, the implication is that younger generations will have to work until they are in the grave.

I'm in the process of buying my first house, and I'm pretty sure I'm putting more down than my parents paid for their whole first home.

I bought in 2019 and my down payment was half of what the house originally sold for in 2009. We're all fucked.