this post was submitted on 15 Mar 2025

760 points (99.6% liked)

Political Memes

7119 readers

1801 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

As a leftist, if he were to actually do this, it generally seems like a good idea to me. (Although 150K is probably too high)

Disregarding the rest of his policies, are there any leftist arguments why this particular measure would be a bad idea ?

(Please respond politely. This doesn’t mean I like Trump, I still think he’s evil and stupid. But even Hitler himself had at least one good idea : being vegetarian.)

The Democrats accomplished a balanced budget in the 90's under Clinton. Can you guess what the next 8 years of Republican control did to that?

Trump did not have this idea, he is repeating noises he once heard someone make. Once you assume Republicans operate like the fae in old stories, everything starts to make sense: Everything they do is designed to trick you so they can take advantage of you. Absolutely none of what a conservative does is unselfish; by definition they are driven to prevent any and all change, except what they seem acceptable. Agreeing with anything they propose, no matter how good it sounds, is a self-deprecating move.

Depends on how the income is replaced for the federal government.

If you look at income taxes as a way for the federal government to keep things running for all citizens to enjoy, you could argue that every citizen should pay a fixed even amount, roughly $15k a year. (based on 2024 IRS Income tax collection and estimated population)

Federal minimum wage makes ~15k a year so minimum wage jobs turn into basically slavery for the feds where the slaves are homeless. The average family of 5 in the US, who have a mean income somewhere around 70k now owe 75k in taxes putting them and any poorer families into debt with the government, before being able to feed, cloth, and house themselves and all other taxes are off the table.

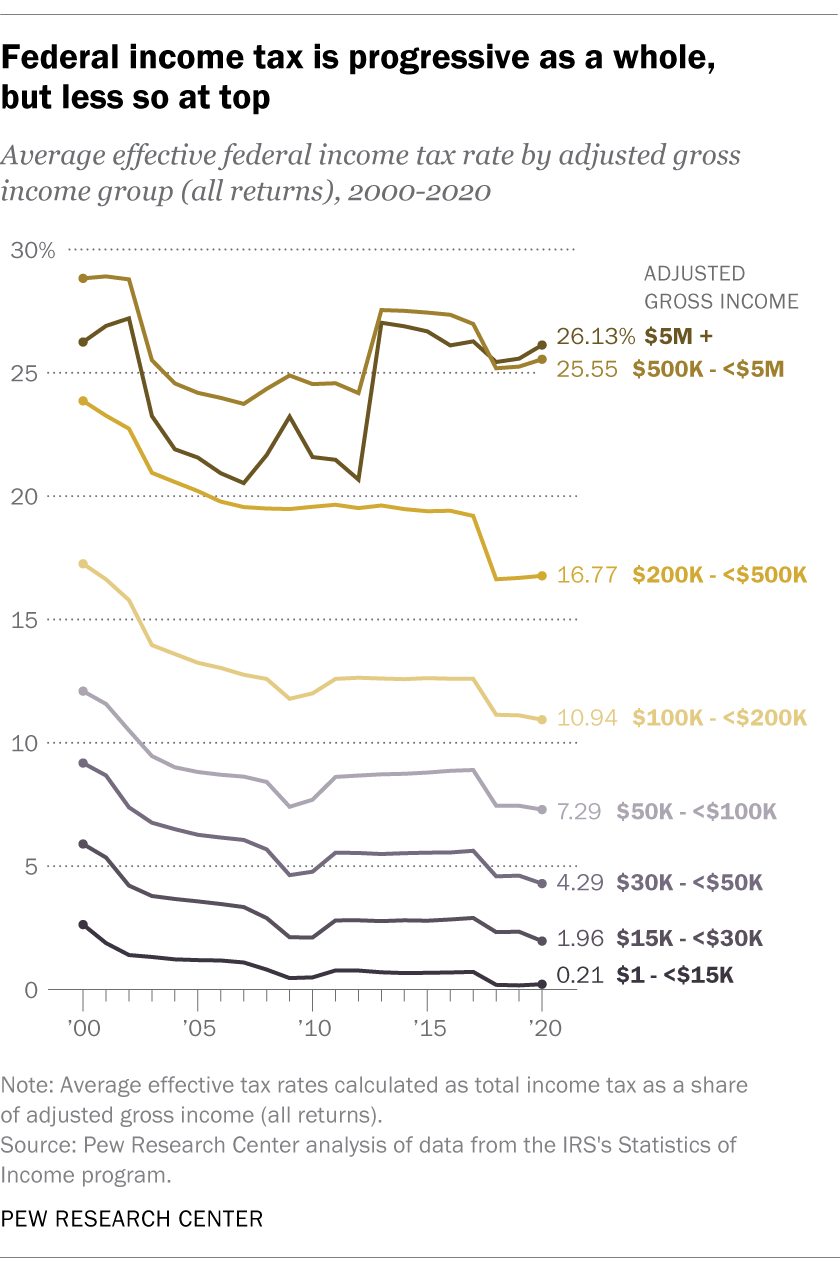

As it stands right now, single filers making 90k AGI owe about 15k so people making less than that are basically being subsidized by anyone making more.

If you keep the IRS income tax revenue the same, but apply it to only earners of 150k+ AGI you have ~20% of the population shouldering the full $5.1T income tax. Spread that evenly and now they would owe 70k per person (currently they owe ~29k) You can play the tax bracket game again to slowly ease people into paying that amount, you're only increasing the amount of taxes being paid by the higher earners. If that's what would actually happen, then sure this is can be a good thing to help bolster the economy in terms of more money flowing between citizens, but there's no way in hell this administration will raise taxes on the higher earners in the US.

If Trump did this, what would be more likely is the income revenue gets replaced by sales taxes and tariffs which is closer to the first scenario I described where the federal income is more evenly distributed among all citizens, working or otherwise.

And the revenue will have to get replaced, the federal government subsidizes the fuck out of almost everything and even the 1%ers do not want a reality where the DoD isn't issuing multi billion dollar contracts. You can't make a living scraping off the top of contracts when there are no more contracts. Trump and co. celebrating millions of dollars saved by the federal government aren't even making scratches against current revenue from income taxes, it's political theater just like this tweet

we ofc already have graduated tax brackets but it needs to be shifted upwards so that people making below a certain amount should pay zero Income taxes (I'm not talking about a wealth tax or carbon tax or VAT tax).

also, top marginal rates NEED TO BE INCREASED AGAIN. during WWII the wealthiest paid between 80-95%. from the New Deal until Reagan destroyed the country in the 80s, top rates were well above 50 percent.

Taxing the ultra rich is how America funded higher education, built the highway system, funded social welfare, uplifted 2 generations, built a global manufacturing and technology economy, and created a prosperous middle class. we did it by keeping oligarchs in check. in a strictly enforced progressively tiered system, top marginal tax prevents the obscene accumulation of wealth

making enough leeway in the budget to actually eliminate taxes for that many people would mean eliminating, at a guess, almost every program the government pays for as well as a significant amount of military spending. There would definitely be no more medicare, social security, or infrastructure investment, just "rich people" paying interest on existing debt.

Setting aside the fact that he's lying --

You'd have to make up the lost tax revenue from somewhere. Either by increasing or creating some other tax, or by cutting spending.

The programs that would be likely to be cut are ones that poor people need. And he's likely to try and throw down a federal sales tax, which loads a higher tax burden on poor people.

Without those details, "eliminating federal income tax for people making under $X" cannot be qualified as good or bad. You must define the other parts of the equation.

Okay, that’s fair. I guess you really can’t dissociate this measure from the wider context.

Not taxing low earners could be part of a set of positive measures, but as it is, it would just mean even less money to do things with.