this post was submitted on 23 Jan 2025

1173 points (99.1% liked)

Political Memes

8012 readers

2641 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Nobody in the US knows how marginal rates and progressive tax brackets work, you can sell the fools on anything and just blame the IRS because it’s the most convenient incarnation of what people hate.

It makes me angry when I see people talk about how getting a raise would be bad for them because it would put them in a new tax bracket.

Like dude, no, it won't be worse. Thats not how that works.

It's by design.. the same group of people think that tarriffs are paid by foreign companies. Keeping voters ignorant is a key part of their strategy. Remember that trump once said "I love the poorly educated"

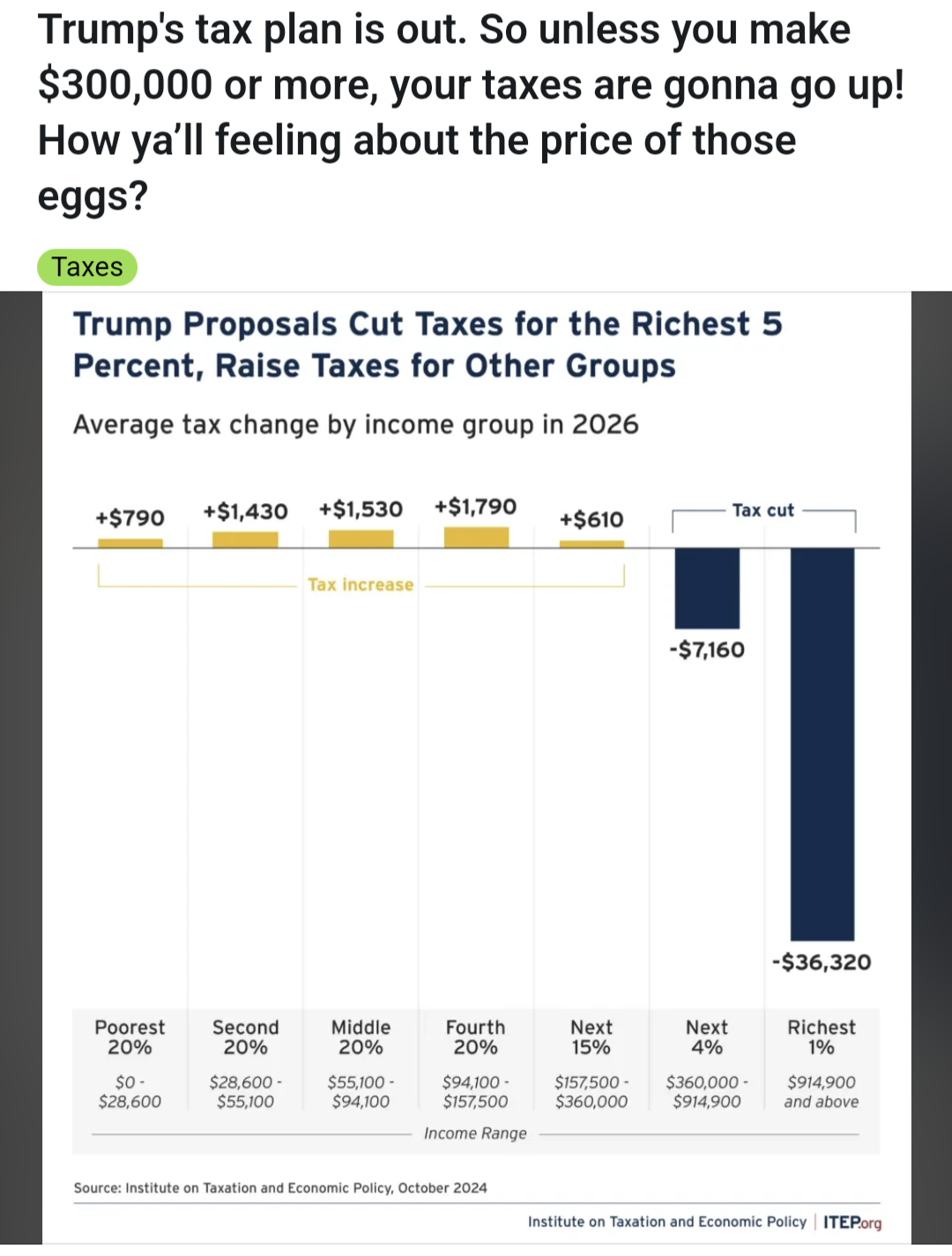

I mean even this post got it wrong, your taxes go up until about $1 mil, not $300k.

But the cuts could start benefiting you at the $300k bracket relative to before. What's the actual change?

Because the way marginal taxation works if you make 300k you paid all those extra brackets tax hikes before you got to 300k and started seeing the lower marginal rate.

So to see your impact you add every changed number from the left up to your income, that’s your impact.

Yes it takes a positive turn at 300k, but you’re already deep in the whole and don’t turn to actually positive until around the final bracket.

It says average cut, so I think it's for the average person of each bracket. So it's talking about folks making $600k maybe? Just guessing.

Why should it be better over $300k though? Thats a tiny tiny percentage of the population who very likely already has more money than they would need for the rest of their lives if they wuit working today, reguardless of age.

People should not be allowed to hoard wealth like that.

This graph should be savings early on, which still benefit those people, because, as you mentioned, it adds them up, but at some point, it gets worse.

Incentivise "spread the wealth". Lift everyone up, because by 300k, you are good, let others get more.

Yeah I definitely wasn’t advocating for that, was just explaining how that worked with marginal tax rates.

I know how marginal taxes work and you didn't address my question. If the tax on above $300k is less than it was before you are paying less. What is this about something changing at $1 million?

I think what they're saying (I didn't look at the data yet) is that while the rate at 300k is lower, that lower rate doesn't make up for the higher rates that individual will have paid until that point. So for the individual in question, the net positive doesn't happen until 1m.

Ah yeah. Might just be a bad graph since it says "by income group" and then breaks down by the actual bracket. Not sure exactly which it means still but I think they're right

No! Noooo! I didn't push your child and spit on you! The corrupt IRS fucked up on your taxes.