The top 10% own 67% of the wealth in the U.S.

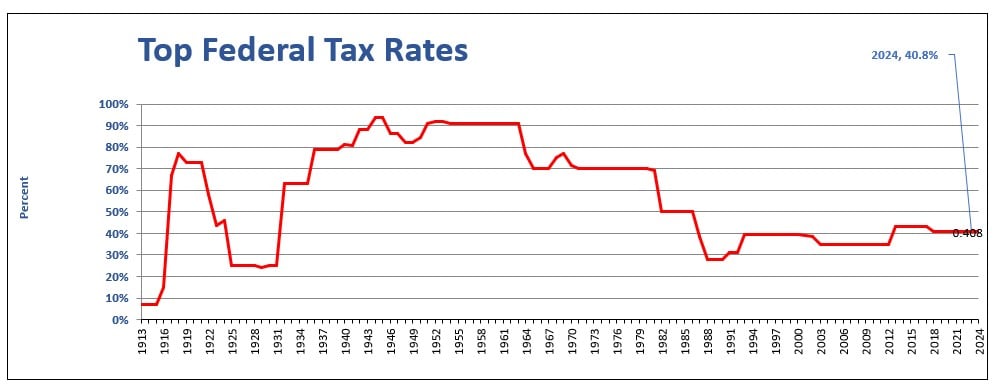

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50's through the early 80's, that tax on the wealthiest was at 70%.

Now it's at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you'd only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.