Wait now he wants acts/legislation to be legit?

InsanePeopleFacebook

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

It's in the bottom drawer of the desk in the room that has a flag with a fringe. Or something.

This list of covcits getting away with anything at all is pretty short compared to what they attempt- like 0.

Actually Tort law in every state makes any debt null and void if payment in legal tender is refused. A promise note, whatever the fuck that is, does not constitute legal tender. That's why your dollar bills say they're legal tender for all debts public and private. And also why people have gotten away with paying large debts in pennies just to be an asshole.

As they say, In God we trust, all others pay cash.

According to Snopes, your first statement is not accurate:

“The designation of coins and/or currency as "legal tender" does not mean that all merchants must accept that form of payment for all transactions. In short, when a debt has been incurred by one party to another, and the parties have agreed that cash is to be the medium of exchange, then legal tender must be accepted if it is proffered in satisfaction of that debt. However, otherwise the selling party may set the medium of exchange to be anything they choose: dollars, bananas, precious gems, feathers, whiskey, etc. They may also choose to accept cash payment only via alternative forms (e.g., credit/debit card, check, money order) rather than currency itself.”

“although no federal regulation requires businesses to accept currency and coins as payment, local regulations may do so. Massachusetts has had such a law in place since 1978, and New Jersey enacted similar legislation in 2019. A few cities (e.g., San Francisco, Philadelphia) have prohibited stores from going cashless as well.”

Merchants don't have to accept legal tender because you haven't incurred a debt by attempting to purchase something, other than a few states as you have mentioned. It's not a debt, it's a market transaction. Tort law also includes provisions to be considered in the case of contracts. Absent other provisions, legal tender must be accepted if offered, and refusal of tender by a recognized representative of the creditor nullifies the debt.

That's why your dollar bills say they're legal tender for all debts public and private.

Well, I think I can spot the sovcit solution to the this problem from a mile away, and it's the shape of a sharpie.

Also, promissory notes are definitely a real thing, but more so if you're, say, importing a ship full of cargo from another continent. Not so much if you're paying for your car.

They are a real thing, but they are not legal tender.

As soon as the can get the Secretary of the Treasury to sign their monopoly money, they'll be in business.

Put some money in a can of spaghetti-O's and see if they refuse it?

Pretty sure that would "vandalise" the money, making it no longer required to be accepted...

I love how these dumbasses always think they found some magical loophole to cheat the system. Would you want your wages to be paid by a "promise note"? No? That's why it's not a real, legal thing.

Thing is, the entire monetary system is kind of a promise note, just a rather reliable and legally enforceable one.

Even something like a payment plan is essentially a promise note, credit cards too.

Yeah, but like you said all those things are backed and based on the US dollar. Company scrips have been illegal for decades. This guys idea of a promise note seems more like an IOU scribbled on a napkin.

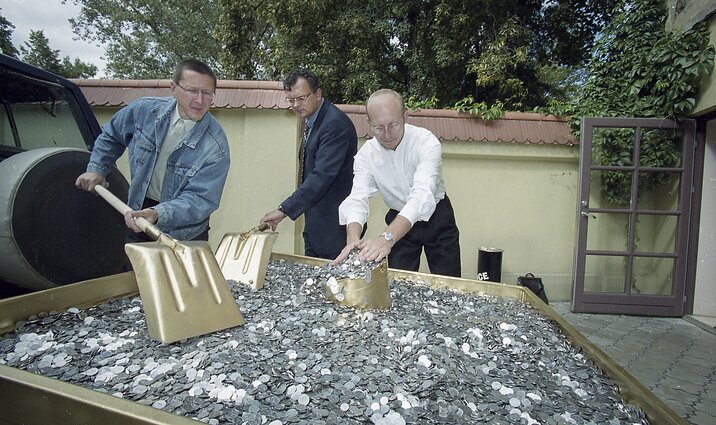

Local proof of this:

A local artist received a 15000 LTL (now unused currency, now 4350 EUR) fine for calling in a fake bomb threat at his friend's wedding. He proceeded to pay it in cent coins, which weighed 700 kilos.

Regarding promissory notes, they are definitely a thing, also known as a note payable, two people agree that x will pay y with a certain amount and interest and it is as good as money, but you can't just randomly write one up.

But is his promise note actually a promissory note? Or is it some sovcit bullshit to avoid banks?

It's only a promissory note if the bank agrees and signs it too.

I suppose he will try to make a fake promissory note and try to give it to the bank.

huh interesting… in australia there’s an upper limit on the amount you can pay with low denomination coins

5c coins are legal tender for amounts not exceeding $5 for any payment of a debt.

https://en.m.wikipedia.org/wiki/Australian_five-cent_coin#cite_note-4

In general you can get away with it once in the US. After that, it's still payment, but is also considered harassment, and they'll charge you for it. There isn't a law against it, because they'll apply other laws if you do it

Wait, so, if I owe you 6,05 AUD, it's impossible to pay you in full with legal tender?

No, 5c coins are legal tender unless there's over $5 worth of them.

Also, legal tender is what must be accepted. Someone could still choose to accept a payment that doesn't count as legal tender, so even if it did work the way you interpreted it as, someone wouldn't be obligated to refuse any payment over $5 that included a 5c piece. It's so you can tell someone trying to be a dick with how they pay you to fuck off without losing the amount they pay you, not for fucking with people trying to make a good faith payment.

And besides both of those, electronic payments would still be a way to make that payment in full.

this is correct, yes

and afaik any entity with a banking license must trade whatever (perhaps within reason?) amount of 5c pieces for larger denominations, so it’s not like you couldn’t pay if you only had bunch of 5c pieces; you just have to do the work to convert it to something less annoying

In Canada, above a certain amount they need to be in rolls. But rolling machines are also a thing, though there's a limit to how fast you can feed them.

If you found yourself in possession of Scrooge McDuck's pool of coins, you might not be able to convert it all in one trip, but you'd be able to spend it all eventually.

The Canadian currency act, where those limits are stated, is silent on the subject of rolls.

Ah thanks for the correction. I must have mistaken a convention or specific business' policy for law.

I can’t speak for Canada, but in the US some banks require rolls while others require loose. The bank I worked for we required loose because we put them through a machine coin sorter. Smaller banks the tellers sometimes have to hand roll coins themselves so if you’re bringing in an excessive amount they have bank policies that it must be rolls. On the other hand we would have to break open any rolls you brought in because it’s very easy to fake rolled coins.

I assume it's $5 worth of 5c coins total. So you could pay a $10 debt using one bill of $5 and 100 coins.

Ah that does make a lot more sense than my reading.

That's the way I've understood our law, yes...

Part 2, section 7 of the Candyman-Beetlejuice Act of 1988.

Further reinforced in the federal court decision US vs Bloody Mary

I'm proud of you guys. A lot of people confuse these for the Beanstalk Doctrines, but you guys are sharp as hell.

It's easy to see how that happens though, the 'fee, fi, fo, fum' legal standard has four elements but it's easy to forget one.