this post was submitted on 28 Jan 2024

283 points (99.0% liked)

InsanePeopleFacebook

2624 readers

19 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

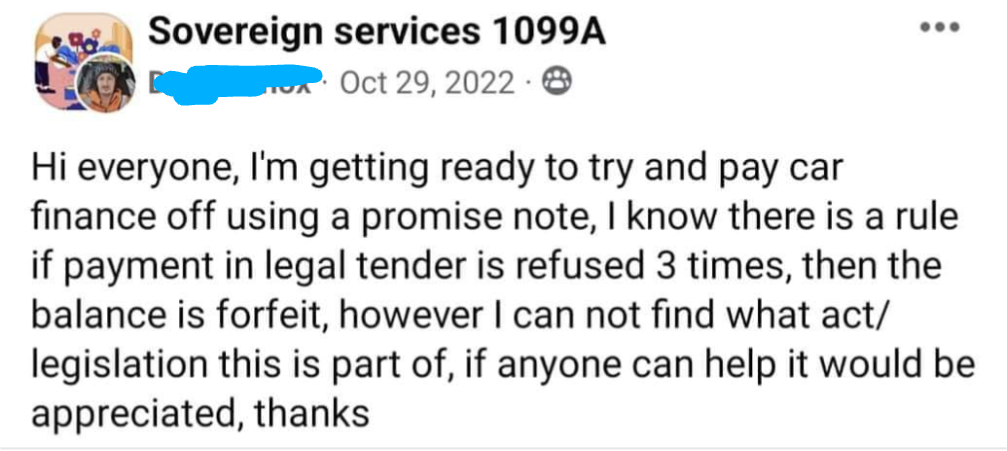

According to Snopes, your first statement is not accurate:

“The designation of coins and/or currency as "legal tender" does not mean that all merchants must accept that form of payment for all transactions. In short, when a debt has been incurred by one party to another, and the parties have agreed that cash is to be the medium of exchange, then legal tender must be accepted if it is proffered in satisfaction of that debt. However, otherwise the selling party may set the medium of exchange to be anything they choose: dollars, bananas, precious gems, feathers, whiskey, etc. They may also choose to accept cash payment only via alternative forms (e.g., credit/debit card, check, money order) rather than currency itself.”

“although no federal regulation requires businesses to accept currency and coins as payment, local regulations may do so. Massachusetts has had such a law in place since 1978, and New Jersey enacted similar legislation in 2019. A few cities (e.g., San Francisco, Philadelphia) have prohibited stores from going cashless as well.”

https://www.snopes.com/fact-check/legal-tender-payment/

Merchants don't have to accept legal tender because you haven't incurred a debt by attempting to purchase something, other than a few states as you have mentioned. It's not a debt, it's a market transaction. Tort law also includes provisions to be considered in the case of contracts. Absent other provisions, legal tender must be accepted if offered, and refusal of tender by a recognized representative of the creditor nullifies the debt.