this post was submitted on 15 Apr 2024

725 points (98.0% liked)

Funny

9900 readers

1110 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

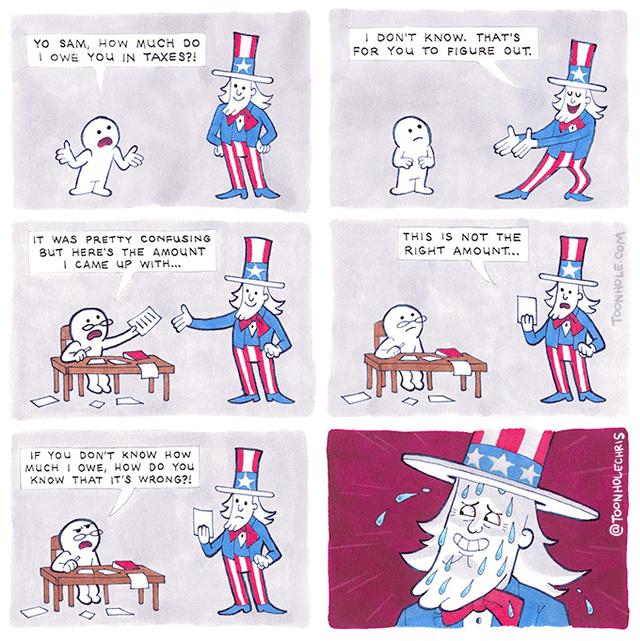

That's fair. My point though is that with higher IRS funding, poorer people are probably going to get audited more, and if you're only using your W-2, you're probably missing something and could get caught with an audit.

Other things that could factor in: