Question for the economists in this thread. Everyone seems to be saying that a lack of at least some inflation is bad but also that wages going up to meet it is bad. Isn't this a system automatically doomed to fail? Eventually in such a setup no one can afford anything and the economy collapses.

News

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. We have an actively updated blocklist, which you can see here: https://lemmy.world/post/2246130 if you feel like any website is missing, contact the mods. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.

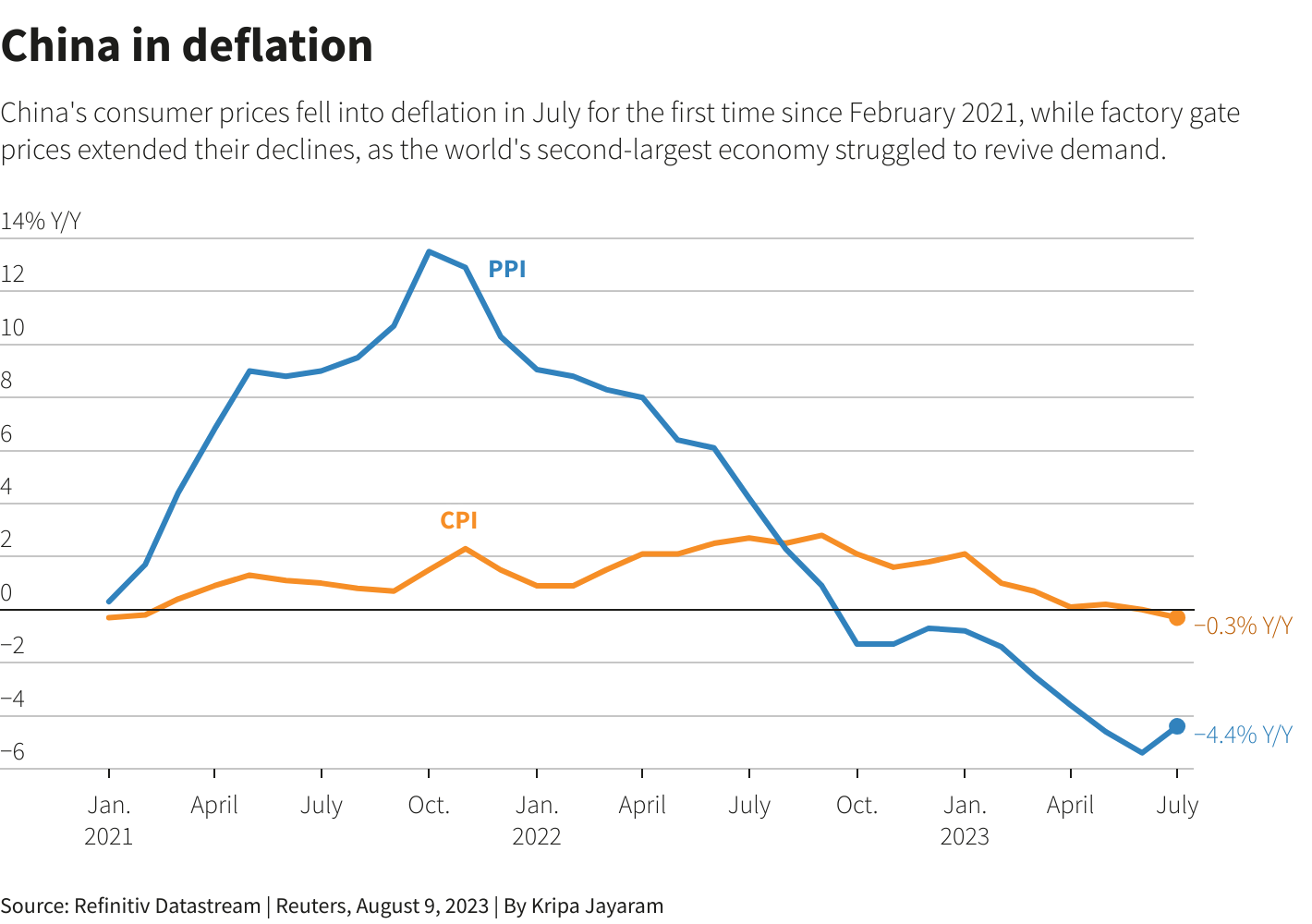

Inflation is easier to handle and not as bad for the economy as deflation, so that's where we are always at.

Yall made your nut with pandemic price hikes, now eat your fuckin crow.

When's the last time the US saw significant deflation? The 30's? Can't say I blame them for their fear. But they'll see no sympathy from me! We've seen two whole generations born, raised, and passing away in the age of "Number always go up!" business. At least the greatest generation grew up hearing stories of difficult times when it was the unions and collectives that brought them through the darkness. I'm sure current business leadership has no clue how to face this. It's passed out of living memory.

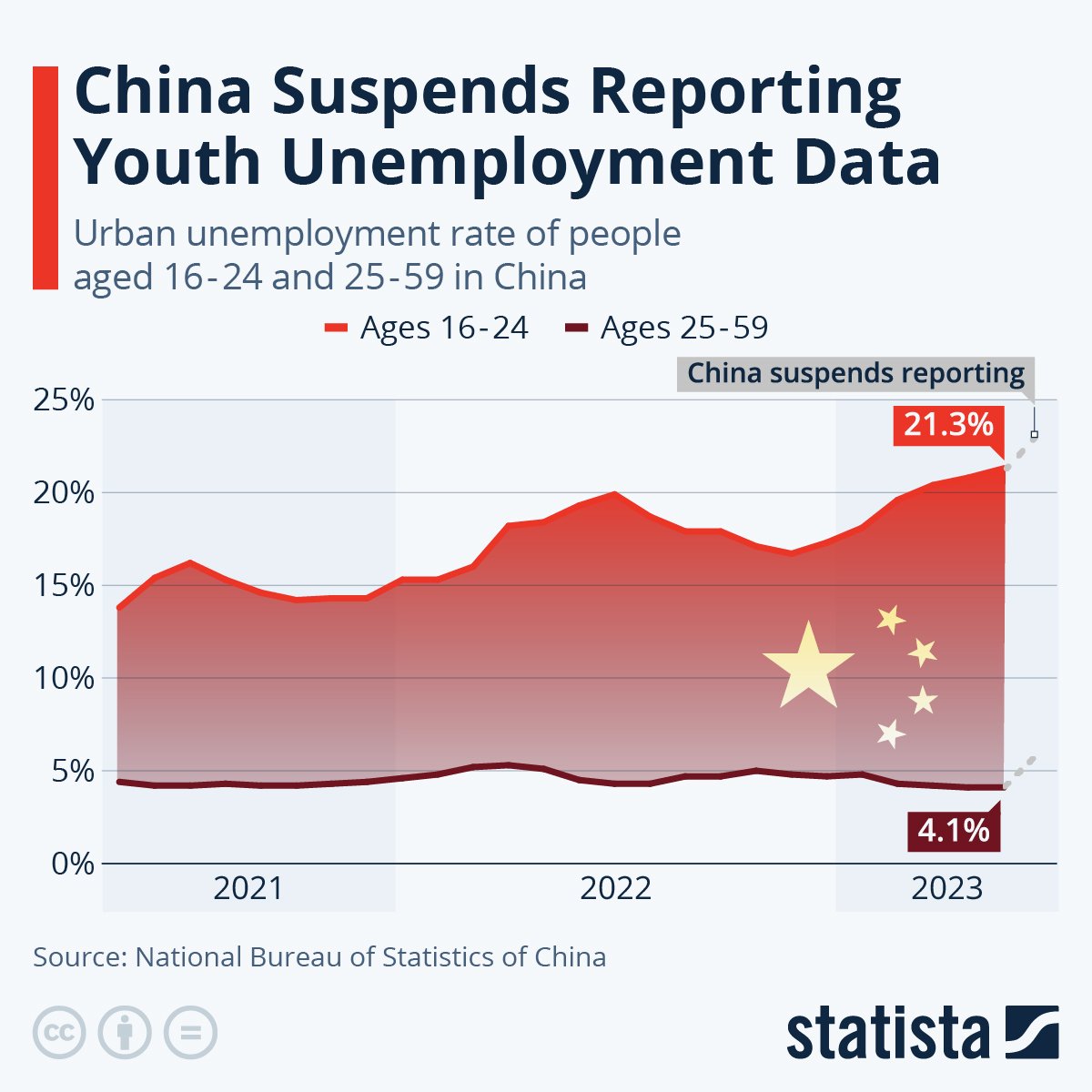

You can see the massive deflation happening in China right now as youth unemployment hits 25%.

No thanks. We don't want that over here. Inflation is (and always will be) better than mass unemployment. If you want lower prices, open up our trade with others (IE: Import China's goods since they're suffering from deflation: we can benefit from those lower prices).

What are the root causes of that deflation though? I would posit the over extension of the Chinese economy in an effort to mimic "Number go up" results without the required fundamentals (see evergrande).

I see "inflation is good" parroted a lot, without much analysis as to why. I understand how continual inflation is a major driver of modern western economies, and those steering those economies require it to support current polocies and the general status quo. However, that being said, I fail to see how that makes it required for things to be "OK".

The price of a raspberry "inflates" in the winter, and "deflates" when in season. The price of commodity consumer electronics is in a continual state of deflation, as new teohnology emerges. At the microcosm prices move in both directions frequently, and are just deemed adjustments. Why then, at the macro scale is a continual increase in pricing considered a sign of economic health?

You're getting supply and demand confused with inflation.

Inflation is a rise in the general price of goods. One item changing price (like a Taylor swift concert ticket) isn't inflation, especially peak pricing.

Explaining it is much more than a commet length, but ill try before my phone dies.

As gdp increase (better efficiency, more good sold, new markets, value add services) more people are employed to do this work. Unemployment falls when this exceeds the growth of a population from either new people entering the workforce or immigration and against retirement and death. Okuns law.

As Unemployment falls, inflation increases. Less people employers are fighting over means perks and wages increase, driving inflation and costs of production. Phillips curve relationship.

Effectively, economic growth results in inflation.

If I had more time, changing the OCR affects components of GDP, changing inflation through these methods. But there is alot that goes into the logic.

This article makes me want to vomit. All these companies and CEOs talking about inflation like it's this intangible phantom that nobody can get a grasp on.

“If one looks at inflation over time, we very rarely get into periods of sustained deflation. That’s just not a consumer effect,” Coke CEO James Quincey said Feb. 13."

It's the companies and CEOs price gouging. Call a spade a spade for Christ's sake.

They're incapable of sincerity.

New challenges for retailers such as:

Not hitting record profits year after year. Reducing their CEO from a five yacht household to a four yacht household. Finding ways to hardline lobby to reduce taxes to zero.

Hah. Like the CEOs will bear any brunt of this burden.

We have a collapsing climate, and no plan B, but yeah, this is what we should be focusing on right now...

Only when a person stops worrying about tomorrow can they worry about next week.

They tighten their belts, we tighten our belts, everybody loses. All because they got to have all the money and never leave anything on the table for the working class.

Profits must always go up.

Guillotine's can also go up.

I like it best when they come down.

The spice must flow

Blood for the blood god!

Retailers fear things that would help consumers consume? Sounds like retailers don't know how to succeed without gouging.

You'd think it would help consumers consume, but if deflation is too steep and too extended people start rationing as much as they can because they don't want to look like an idiot for buying that gallon of milk this week instead of next when it'll cost half as much.

Yes, I'll skip eating this week to save $50

OR, hear me out, I'll just spend the money because I'm hungry

Traditional economic theory- yes. Hence why deflation can cause such issues.

However, there is also a significant part of consumption that you will make regardless of price, because the alternative is death. (C0 and C1 for anyone who took first year).

The problem is prices grew soo much our entire spending is now limited to essentials (c0), and even if I knew it would be cheaper next week im only getting it because I need it now.

The last time USA had extended deflation, the Great Depression happened. When people stop consuming, retailers fire their workers. Then fewer people can consume, so more people get fired. This goes on enough, then its not just stores who fire workers, but it trickles to factories, R&D, office workers, etc. etc. The longer deflation happens, the further it spreads and the more people lose their jobs.

Ever since the Great Depression happened, US Policy has been strongly anti-deflation. Our policy is to "err" on the side of slight inflation.

We are not at risk for any sort of sustained deflation. Inflation is currently over 3% (higher than the Fed's target of 2%) and interest rates are very high. We have a lot of wiggle room if inflation starts dropping.

We currently have a high base interest rate set by the fed. The country can fight deflation easily by cutting the rate from its 5 base points, which will increase lending and spending

This shouldn't be an issue now.

The debate is whether to cut the FFR yet.

I'm against it. But people are rightfully worried about deflation. Its a terrifying situation from an economic point of view.

But you're right. There's very little sign of deflation (yet). We can hold rates higher, and maybe even go another +.25% up. Inflation is at a safe level right now, not too high and not too low, but we need to stay on guard to make sure it stays in this golden zone, and move as appropriate.

There were too many new jobs (too little unemployment) again in January. So we might still have rates too low IMO.

So what happens when retail workers don't get paid enough to consume even with jobs?

Prices drop, causing more people to get fired. IE: The Great Depression. Or if you want a modern economy that's undergoing this shift, just look at China right now.

If people can't afford things, your only choice is to fire workers and drop prices further. That's just economics. (Why do you need workers? No one is buying anything, so fire your workers. Duh). The more people realize that this is the only strategy to survive, the lower prices get, the more people get fired, and the less that people can consume. It gets worse and worse until economists change policy and pull you out of this.

This is why we have large pseudo-government central banks keeping watch over our economy. Deflation cannot be tolerated. Yes, inflation sucks, but at least people still have jobs and livelyhoods in times of inflation or hyperinflation even. That's actually survivable. Deflation is NOT survivable, it sucks so much worse. Deflation is all-hands-on-deck we need to work together kind of situation. We never want to push the economy to that direction.

China isn't doomed btw. China's plan is to exports goods to Europe and hope that Europe buys enough Chinese crap that they can kickstart demand again. And as prices drop further and further, Chinese goods will get cheaper, and crap like Temu will pop up to sell these cheaper goods to everyone. Now there's geopolitical repercussions to this (not everyone will want to support such "dumping" of goods into our countries), so there's no guarantee that China will be successful on this front.

China is doomed for a number of other economic factors, deflation is just the symptom.

China’s housing crisis is the primary driver. The Chinese saw land as the primary means of savings and investment for the last twenty years. Much of the economy and state funding was driven by a demand for investment housing. Now that that has stalled many people’s savings have been wiped out.

Couple that with trade wars brought in by an aggressive foreign policy and it makes for a very challenged economic environment. China’s very centralized top down decision making process is great for directing growth but it struggles to address a number of issues at the same time to the point of paralysis.

China is facing an existential crises that is only starting to unfold.

In that case tie minimum wage to inflation so no matter how bad inflation gets the poorest don't lose their shirts (and stop consuming)

Oh, so in times of deflation you want minimum wages to drop automatically? Deflation is "negative inflation". I'm talking about the inverse scenario compared to what you're talking about. Sorry, that sounds like a terrible idea.

And unfortunately for your argument... despite the high amount of inflation in 2022 and 2023, consuming rose dramatically. Or did you forget how ridiculously overpriced everything got, all those shoes / collectables people bought and the stock market skyrocketing as too much money was flooding the markets?

That's called an "overheated economy", too many people did too well during the times of inflation. That's... kind of the problem. Inflation happens when lots of people make more money.

IE: Emperically speaking, we can just look at the results of the last ~3 years of the USA's economy. Consuming went up with inflation, just as expected. There's no need to "encourage" consuming during inflationary bubbles.

In fact, what got inflation under control was the huge amounts of +Interest Rates encouraged by the FFR. Did you not notice the dramatically higher credit card rates that are cutting into people's budgets? That's almost by design, increasing the FFR increases all loan costs (house mortgages, credit card bills, and car loans). That's how we fix inflation, by kind of destroying money / taking money away from people.

We should have increased taxes instead IMO, so that our budget could have been managed better. But whatever, inflationary-bubbles are caused by over-consumption. The goal when inflation/hyperinflation is occurring is to cut back on consuming, and you discourage that by doing policies that are deflationary in nature.

IE: The Fed is currently slamming on the brakes (ie: doing policies that risk a deflation right now), to cut back on the chances of inflation. That's why retailers are scared, they're worried that the Fed is pumping the brakes too hard / increasing interest rates too much right now.

One issue with raising taxes as a tactic for slowing money supply growth is that it is not very agile. Once inflation gets back under control, Congress is not automatically going to lower the tax rate. I do agree that we should raise taxes but that's more for four the budget deficit and the high wealth inequality.