this post was submitted on 21 Feb 2024

0 points (50.0% liked)

General Discussion

12071 readers

46 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: [email protected]!

Also keep an eye on:

For more involved tools to find communities to join: check out Lemmyverse!

💬 Additional Discussion Focused Communities:

- [email protected] - Note this is for more serious discussions.

- [email protected] - The opposite of the above, for more laidback chat!

- [email protected] - Into video games? Here's a place to discuss them!

- [email protected] - Watched a movie and wanna talk to others about it? Here's a place to do so!

- [email protected] - Want to talk politics apart from political news? Here's a community for that!

Rules

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to [email protected] or [email protected] communities.

- No Ads/Spamming.

- No NSFW content.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

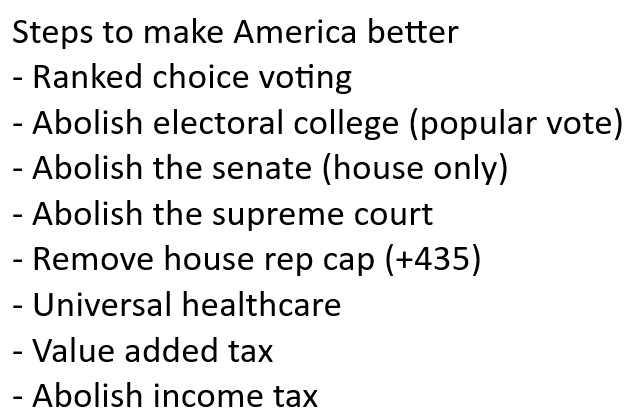

No. What kind of crazy shit is this?

Income tax is one of the only tools that could be used to combat inequality

Here, if you'd actually like to learn why income tax doesn't work and why it disproportionately impacts the poorest workers: https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

This is incredibly misleading. I thought propublica was better than this. They calculated these billionaires “true tax rates” based on unrealized gains. Until they cash out they don’t actually make the money.

You can argue for higher income tax brackets, or a more progressive capital gains ladder, or regulations in banking stopping rich people from using other peoples money based on equity they have or any number of way more complicated things that aren’t income related, but outside of just a wealth tax which is something entirely different, these true tax rate numbers are nonsense.

His idea that an income tax is super regressive because the wealthy can live off "unrealized gains" is wrong. But so is your assertion that they don't actually make money until they realize the gains.

Wealthy people live off of low interest loans that use their stock as collateral. However as long as the green line goes up, they never need to really worry. And when payment comes due it just gets rolled into another loan. The primary mistake the merely rich make when trying to move up is transitioning to this model too early or too aggressively and losing their stock collateral.

This is also how billionaires take a 1 dollar "paycheck" and afford to fly private jets everywhere. "Unrealized gains" is a lie and a giant loophole in our tax system.

I know, and that’s what I was vaguely describing. It’s something entirely different than what’s being talked about.

Capital gains taxes and graduated lending taxes would do far more to combat wealth inequality than income tax ever could

I'd just like to give a shout-out to estate tax, which is the only kind of tax that has the explicit purpose of preventing the establishment of an aristocracy.

Yeah but it also means that families might not be able to afford their own home if the people listed on the deed die.

1 home should be deductible from property and estate taxes for all individuals, and not at all for any kind of corporation or organization.

You must not understand how the rich make money. Unfortunate, hopefully you learn some day.

You want income tax to scale up for 'normal' rich people. You then need additional laws/taxes for the super rich as they operate in a different economic world.

So you're not really asking if your plan makes sense, you're trying to force what you think on others. You'll learn one day.

I'm not forcing anything on anyone, I'm just bringing up things they don't like to hear.