this post was submitted on 18 Feb 2024

2 points (100.0% liked)

me_irl

4678 readers

19 users here now

All posts need to have the same title: me_irl it is allowed to use an emoji instead of the underscore _

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

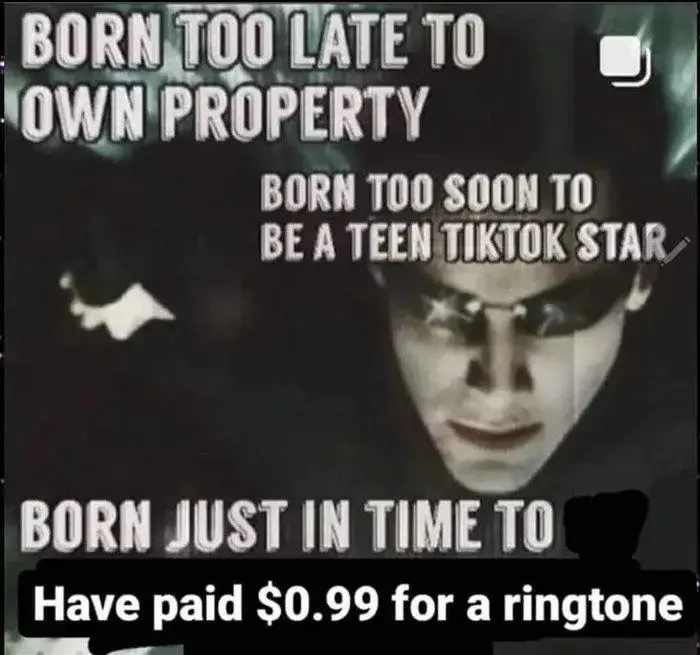

There's obviously a grey area between mortgaging a property and owning outright.

If you want to actually get an idea I'd look up stats on net wealth which includes assets like property.

Everyone's wealth should grow until retirement then begin to drop.

https://www.avtrinity.com/news/what-is-the-average-household-net-worth-in-great-britain

An example of the wealth difference in the UK.

16-24 average below the 15th percentile £22,300

25-35 around the 30th percentile £76,800

35-44 below the 40th percentile £198,000

45-54 at the 55th percentile £366,600

55-67 at the 65th percentile. £553,400

The earnings to bridge the gap seem pretty big even though we're talking about households here so couples can count together very often.

An average 20 year old needs £5500 per year in savings or asset growth to get to the place a 30 year old is in today.

An average 30 year old needs ~£12,500 per year in additional savings and asset growth to reach the average those who are 40 have reached.

A 40 year old needs ~£16,000 a year

A 50 year old needs ~£20,000 a year

This isn't possible without assets with compounding interest and tracking ahead of inflation. It's essentially dependent for most on getting on the property ladder as that's where the majority of the wealth is.

The average house price in the UK is £288,000. Essentially the average would be to own your house by 50, except some wealth is in pensions not property. So really it's at least 55.

25 years average mortgage means those 55 year olds likely got on the property ladder at 30.

The later people get on the property ladder the more of that compounding investment happens later. Interest works against people who still have mortgage debt and below 50% equity. A 40 year old getting on the property ladder is likely to pay off the mortgage on their last house at 65. With 50% equity happening at 55.

Getting on the property ladder at 40 is essentially just in time to have a retirement. Later than that and they're in trouble.