this post was submitted on 19 Sep 2024

1454 points (98.7% liked)

Work Reform

10003 readers

48 users here now

A place to discuss positive changes that can make work more equitable, and to vent about current practices. We are NOT against work; we just want the fruits of our labor to be recognized better.

Our Philosophies:

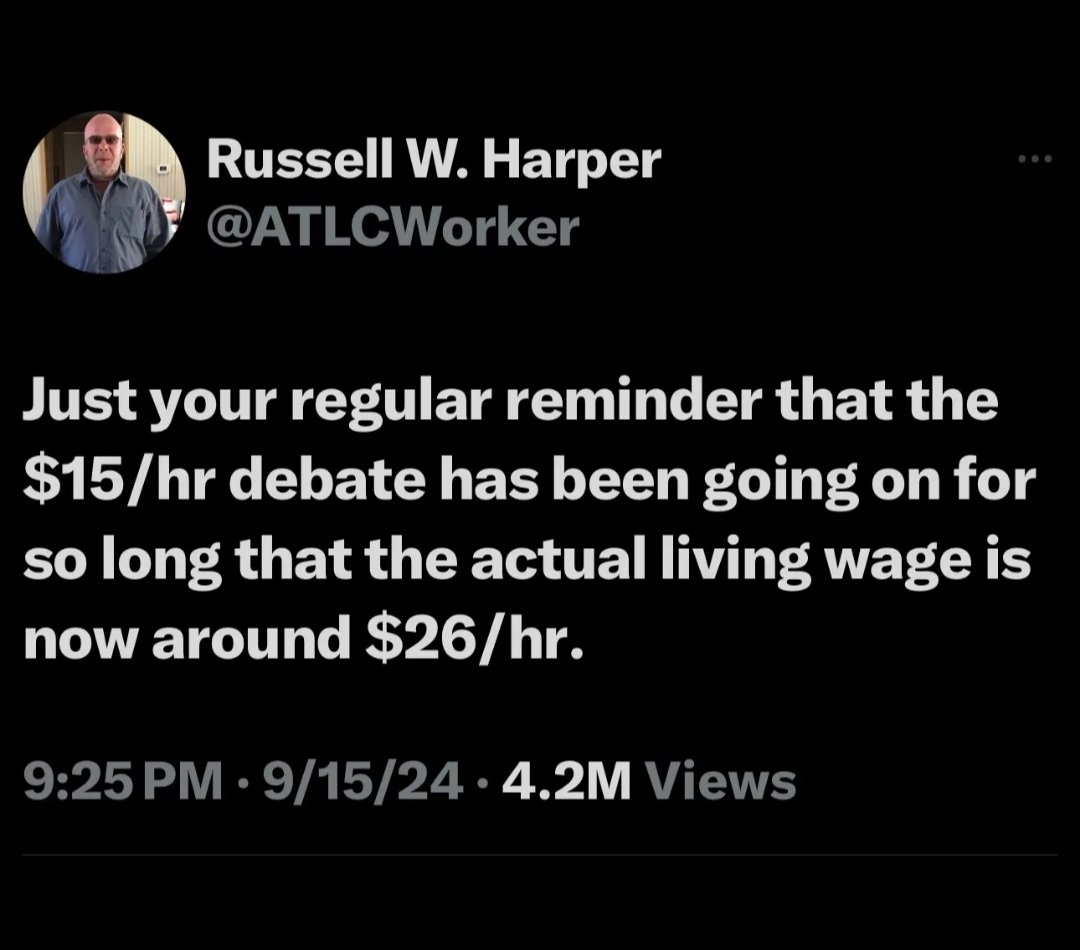

- All workers must be paid a living wage for their labor.

- Income inequality is the main cause of lower living standards.

- Workers must join together and fight back for what is rightfully theirs.

- We must not be divided and conquered. Workers gain the most when they focus on unifying issues.

Our Goals

- Higher wages for underpaid workers.

- Better worker representation, including but not limited to unions.

- Better and fewer working hours.

- Stimulating a massive wave of worker organizing in the United States and beyond.

- Organizing and supporting political causes and campaigns that put workers first.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

It should also be said that just because I already paid my student loans off doesn’t mean I don’t want other people to be in debt. Student loan forgiveness needs to be up there with the livable wage.

Student loan forgiveness is regressive by definition (those lucky enough to go to college are a minority that earns on average $0.5 to $1 million more over their lifetimes, than those who don't), aren't you against wealth transfers from poorer to richer?

If the goal is free education then yes, there has to be a cutoff somewhere

There's some double negation confusion at work here, but I think you wrote that you do want other people to be in debt ;)

Yes. You’re right. Thankfully it seems everyone understands what I meant though. 😊

does your student debt accrue interest?

Yes, enough where its possible to have your student debt die after you.

There are two types of loans: subsidized and subsidized. The subsidized loans do not accrue any interest, as the fed pays that for you. Unsubsidized loans do accrue interest; typically a lower rate than regular loans (mine were 6%). Student loans cannot be discharged through bankruptcy.

🤔 (lol)

That is not correct. Subsidized loans accrue interest, but only starting six months after graduation or when you drop below half-time enrollment.

And the rate is the same for subsidized and unsubsidized, currently 6.53%. https://studentaid.gov/understand-aid/types/loans/interest-rates

My loans were over 20 years old. Things have changed since then.

Probably not after it was paid off

you never know with America