this post was submitted on 14 Aug 2024

1868 points (99.5% liked)

People Twitter

4975 readers

1154 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying.

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Manufacturing is different than IP transfers.

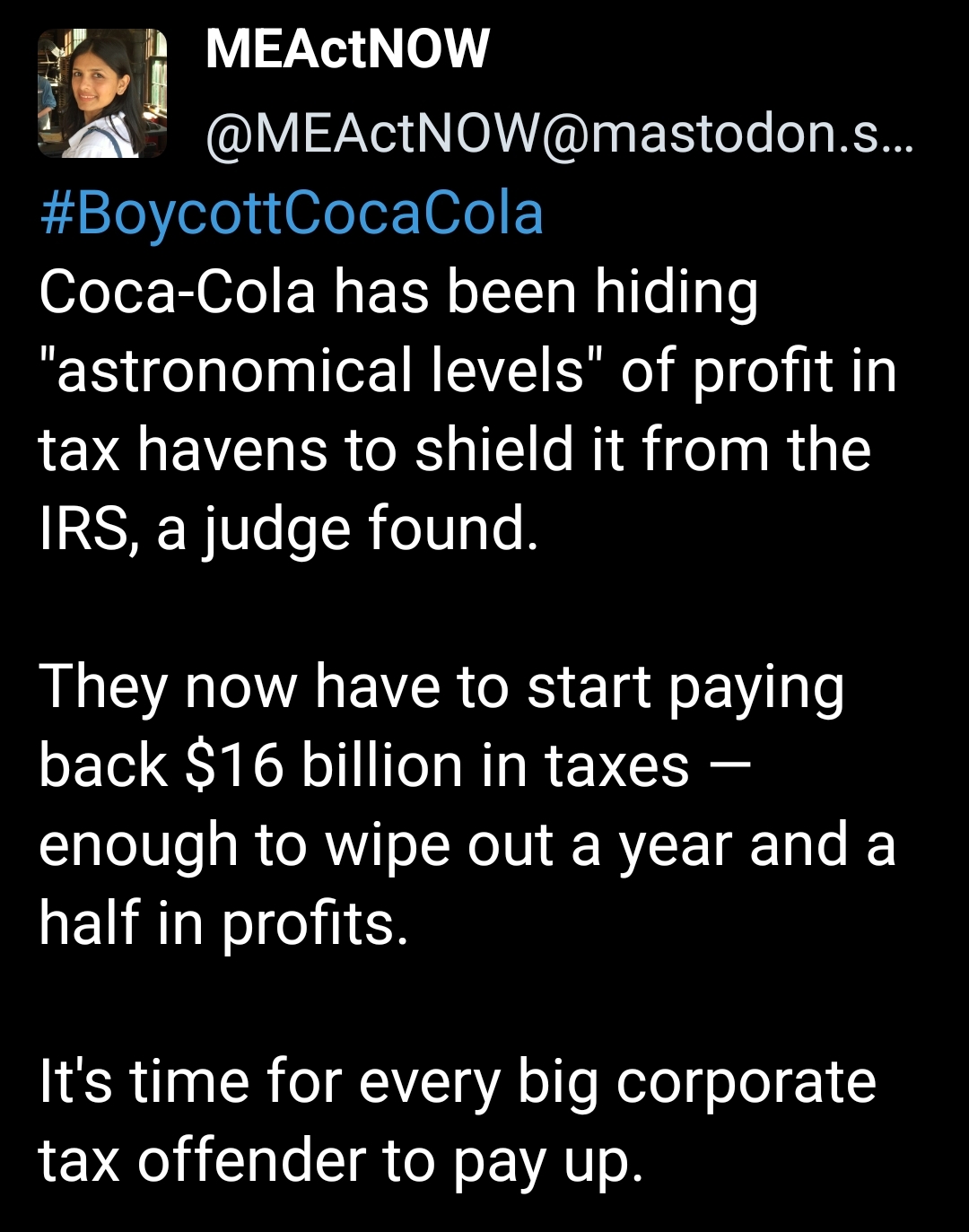

IP is owned by the US. What they're describing is transfer pricing. Subsidiaries are owned by coke hence by definition coke sets the prices under which the US charges for their IP. It's tax advantageous to charge a low amount to shift profits to low tax jurisdictions.

Numbers look massive but overall not large enough. Coke is gigantic and the dispute spans multiple years. The IRS hasn't always covered themselves in glory and they may still fumble a technical aspect on the burden of proof.

Interesting to see it unfold but coke has a history of environmental, business and humane malpractices. This is just another outcome of such business model.