I guess that I need a payment to see through the propaganda. Anyway, the Western European diaspora need to decide whether China is so hard working and innovative that the lazy free riding Pax Americana need to admited that they enforce a de facto command economy with the Bretton Woods Institutions against the invisible hand or whether the Pax Americana need to admit that they are monopolizing everything in foreign countries and then destroying developing countries with blackmailing from protectionist policies.

China

Discuss anything related to China.

Community Rules:

0: Taiwan, Xizang (Tibet), Xinjiang, and Hong Kong are all part of China.

1: Don't go off topic.

2: Be Comradely.

3: Don't spread misinformation or bigotry.

讨论中国的地方。

社区规则:

零、台湾、西藏、新疆、和香港都是中国的一部分。

一、不要跑题。

二、友善对待同志。

三、不要传播谣言或偏执思想。

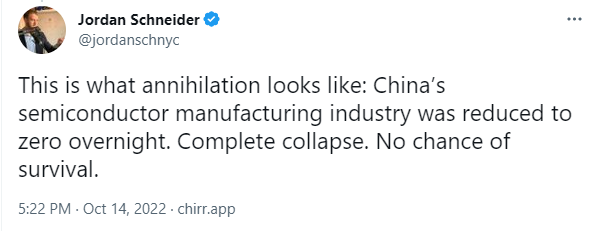

Remember when Chinas chip industry was completely destroyed overnight by sanctions? good times.

Pepperidge farm remembers:

Bragging about destroying the economy of another country is definitely normal behavior. Very democratic of you, America. This inspires trust in the rules-based international order.

I remember:

A classic liberal moment.

“Mission Accomplished” moment

More proof capitalists can only plan 3 months out at max.

As the imperialist group of nations the West fought the fraud the king of production China he began to expand his domain "Unlimited Sanctions"

China shrunk back in fear as West said "stand strong China you are proud" and then he asked West

"If we were to compete who would win?"

West replied "Well if you used your domain expansion Infinite Production it might cause me a bit of trouble"

"But would you lose?"

West smiled and said "Nah I'd win"

Throughout the Global North and Global South, you alone are the GOATed one.

i hate this post

this is an excellent post

but i hate this post

I'd love to see people suggest to avoid tarrifs, go to china to buy computer parts and build the best PC's for the best value.

Walled

Article Text

The writer is the author of ‘Chip War’, a professor at the Fletcher School, a nonresident senior fellow at the American Enterprise Institute and a partner at Greenmantle

On a recent quarterly earnings call, the chief executive of Semiconductor Manufacturing International Corporation, China’s leading chipmaker, predicted a “global supply glut” in the types of semiconductors his company produces. Simultaneously, he announced a $7.5bn increase in capital expenditure.

It may defy business logic but, helped by generous subsidies, China’s chipmakers are ramping up production capacity despite concerns about oversupply. According to one consultancy, the country’s chip production capacity will grow by 60 per cent in the next three years, and could double over the next five. Since western restrictions on the exports of chipmaking equipment to China mean that it can’t produce the most advanced processor chips, much of this production will be of foundational processor chips, which are widely used in cars, household goods and consumer devices.

No wonder trade policy officials are getting nervous that China may flood the market in certain types of chips. The chief executive of TSMC, the world-leading Taiwanese chipmaker, recently noted concern over excess capacity in foundational segments. Other chip CEOs privately say the same. The most pessimistic analysts see China’s investment in solar panels as an analogy, worrying that the country’s chipmaking investment will drive down prices — and western companies’ profits.

Until recently, overcapacity risk was a topic of conversation only among economic bureaucrats and trade lawyers. Now, it has reached the highest levels of G7 policy debate. On January 8, Republican congressman Mike Gallagher called on the Biden administration to use tariffs if necessary to prevent China gaining “excessive leverage” over the world’s economy.

Yet it is not clear which segments might see overcapacity. There are many types of foundational chips, produced in different fabrication plants, with different materials, by different companies. It isn’t guaranteed that Chinese companies will win market share in every sector. For example, the painful pandemic-era shortages have already induced some western automakers to sign long-run supply deals, so they are less likely to buy more from Chinese suppliers even if their prices are lower.

Nevertheless, the US, European and Japanese governments are all debating potential responses to Chinese chip overcapacity. They face complex trade-offs. Tariffs are the usual tool for dealing with dumping, but the west doesn’t directly import large volumes of Chinese chips; they’re embedded inside finished devices. Foundational chips often constitute a tiny fraction of a product’s cost. Some companies don’t even know the origin of chips inside their components. Given the administrative complexity of tariffs, officials are exploring alternatives. One approach is to subsidise the use of non-Chinese chips, though this would require governments to find new funds.

A second option is to limit the market access of specific Chinese companies. SMIC manufactured the sanctioned Huawei’s controversial 7nm smartphone processor in 2023, and the commerce department is formally investigating whether doing so violated US law. If so, China hawks in Congress will demand tough punishment (though western businesses that still work with SMIC will lobby for leniency).

Finally, Chinese chips could simply be banned from “critical” use cases. Intelligence agencies already worry about malicious insertions and compromised chips. Anything from medical devices to electric vehicles might plausibly be considered critical infrastructure.

Europeans look at the problem of overcapacity primarily through the lens of trade harm, not security, so they’ll reject any response they consider non-compliant with the rules of the World Trade Organization. China hawks in the US and Japan are more focused on the security implications. They had few concerns around de facto banning Huawei from telecom infrastructure and would follow suit with banning “untrustworthy” Chinese chips from critical sectors too.

Yet blanket bans may not be necessary if western companies are deterred from buying Chinese chips. Gallagher has gone public with his concern over China’s subsidies, partly to push the Biden administration to act. But CEOs will also carefully parse Gallagher’s statements. The House of Representatives’ committee has already called executives from several large US chipmakers to testify over their ties to China. As governments ramp up investigations of potential overcapacity in China, companies elsewhere will realise that they, too, could be asked to explain the security implications of their reliance on cut-price Chinese chips.

Cheaper PC parts? Yes please!

Not if your government decides to impose tariffs or import restrictions on Chinese chips. The rest of the world will have cheap PC parts but Europe (and to a lesser degree the US) won't.

Just look at what is happening with EVs. Europe and in particular Germany is terrified of affordable and qualitative Chinese EVs "flooding their market" because they know their industries cannot compete, especially now that they lost/gave up cheap Russian energy.

Not if your government decides to impose tariffs or import restrictions on Chinese chips. The rest of the world will have cheap PC parts but Europe (and to a lesser degree the US) won’t.

There is even the possibily of no new PC parts for the west as well if the companies go under and China stops exports too.

I will finally be forced offline to read book. Thank you Comrade Xi.

It's so hilarious, the predictions of tech experts are as accurate as 5 yo

literally what no dialectics does to mfers. these idiots see things as immutable.

But they can’t see that if things were immutable the West’s turn would have never came.